TradeUP Thursday 11/20

TradeUP Thursday

November. 20, 2025

Today’s Editions

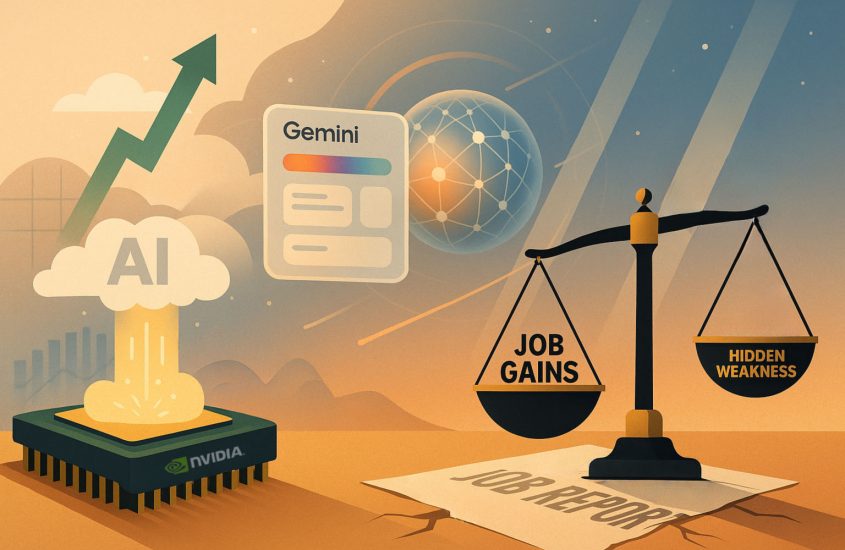

- Can Nvidia’s momentum silence doubts about AI boom?

- Can Gemini’s new upgrade reshape the race for AI dominance?

- Are stronger job gains masking deeper weakness in the labor market?

It’s Time to Vote!

Share your thoughts with us on social media!

This week’s topic is:

Are you planning to shop in this year’s Black Friday?

TradeUP Securities, Inc. is a member of FINRA/SIPC and regulated by the US Securities and Exchange Commission. Registered office: 437 Madison Ave 27th Floor New York, NY, 10022. For further information about TradeUP Securities, Inc., see FINRA BrokerCheck. For further information about SIPC insurance coverage for accounts at TradeUP Securities, Inc., see www.sipc.org or request an explanatory brochure from TradeUP Securities, Inc..

*TradeUP Securities utilizes commercially recognized rates as benchmark when determining the annualized idle cash interest rate. The rate may change from time to time at TradeUP Securities’ full discretion without prior notification to clients. For full details, please refer to the Account Agreement.

All investments involve risk, including possible loss of principal. Past performance of a security, market, or financial product does not guarantee future results. Electronic trading poses unique risk to investors. System response and access times may vary due to market conditions, system performance, and other factors. Market volatility, volume, and system availability may delay account access and trade executions.

No content on the website shall be considered a recommendation or solicitation for the purchase or sale of securities, futures or other investment products. All information and data on the website are for reference only and no historical data shall be considered as the basis for judging future trends.

Please read through our Terms and Conditions before investing.

Comments are closed.